Netflix(NFLX), Slack(WORK), Twitter(TWTR)

Markets have been hit hard lately, yet there are companies which should deal with coronavirus impact relatively well.

Let's take a look at the charts of three tech stocks that could come out very strong from their current setups.

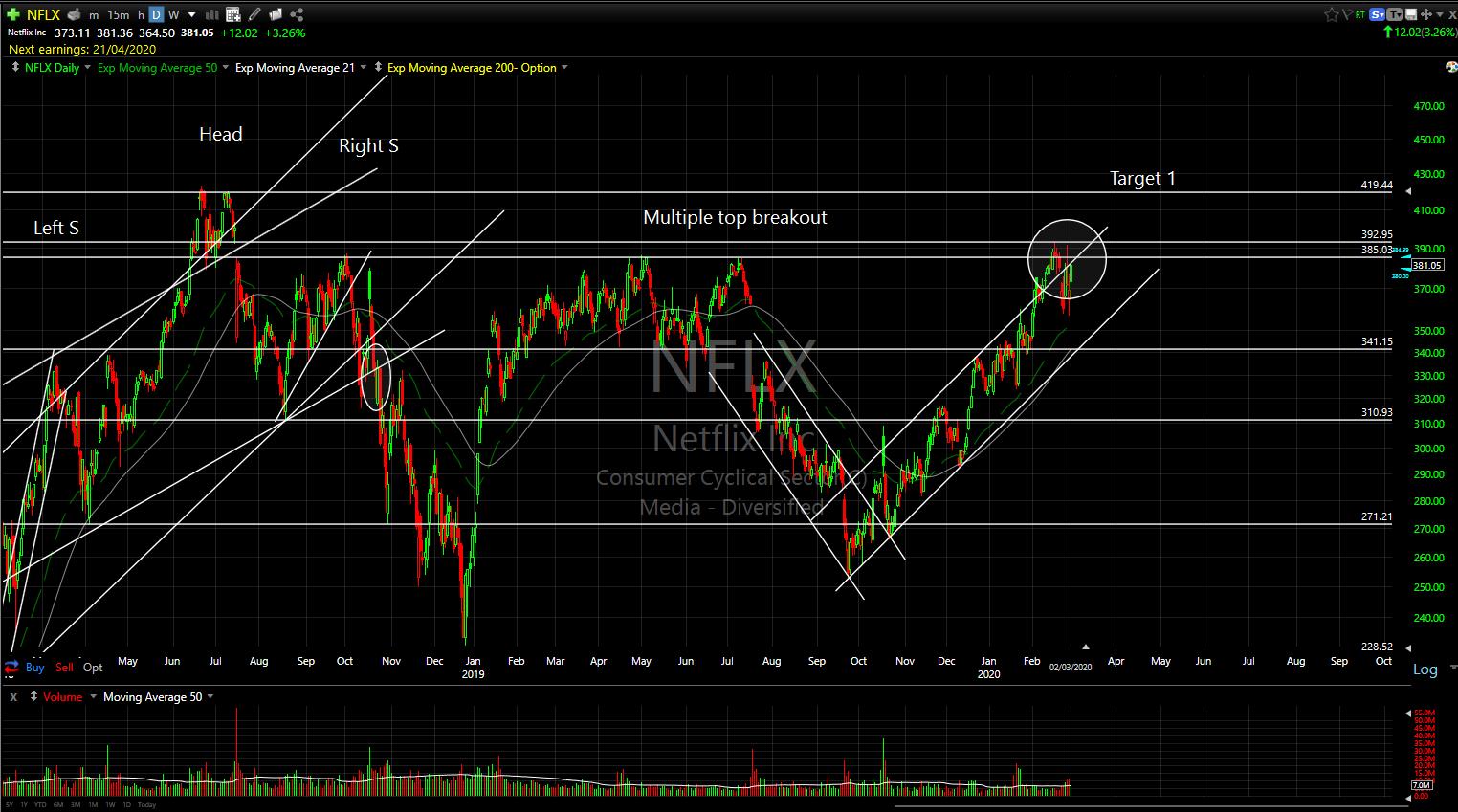

Netflix Inc.(NFLX)

Netflix could be a beneficiary if consumers stay home due to coronavirus concerns. This has been reflected in stock price outperformance over the past two weeks. NFLX is testing multiple top in $385 - $392 range. Break above current high of $392.95 could lead to a significant breakout toward all-time highs. Trigger point: $392.92, Target 1: $419

Slack Inc.(WORK)

Rounding bottom has been forming since its IPO in June 2019. The stock formed a 4-month base and broke out of it in early February. Market turmoil hasn't changed its bullish formation. Targets: $29.37, $31.20

Twitter Inc.(TWTR)

TWTR gained more than 7% yesterday as activist hedge fund Elliott Management initiated $1B stake in TWTR. This put a floor under the stock. This investment, coupled with a strength prior market pullback, should push TWTR back to $39 range quickly.

Happy trading!